It’s no secret that rising mortgage rates are affecting various facets of the housing market, but have you considered how they might be shifting the rental market? As homeownership becomes more expensive, you may find that more individuals are turning to rental options instead. In this blog post, we will explore the implications of climbing mortgage rates on rental prices, demand, and overall market dynamics, helping you understand how these changes could impact your housing decisions.

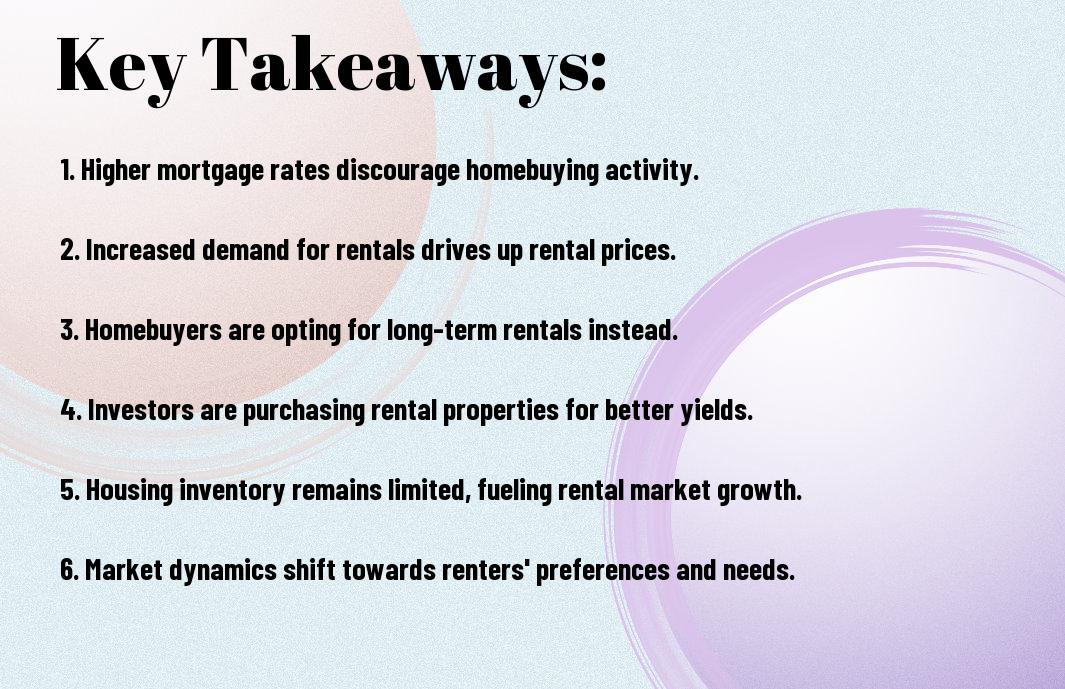

Key Takeaways:

- Increasing mortgage rates are leading potential homebuyers to opt for renting instead, resulting in a higher demand for rental properties.

- This shift may contribute to rising rental prices in many markets, as landlords adjust to the increased competition and demand for available rentals.

- As the rental market adapts, some analysts foresee a potential slowdown in the overall housing market, with longer-term implications for both renters and buyers.

Understanding Mortgage Rates

Your mortgage rate directly impacts your monthly payments and overall cost of homeownership. As these rates fluctuate, they can affect many aspects of the real estate market, including home buying and renting. Understanding how mortgage rates work and their historical trends will help you navigate the current housing landscape more effectively.

Historical Perspective

With a look at the past, you can see how mortgage rates have changed over the decades. Traditionally, rates have seen peaks and valleys, often influenced by economic conditions, inflation, and government policies. These historical shifts can offer valuable insights into current market behaviors and trends.

Current Trends

An examination of recent mortgage trends reveals a steady increase in rates, which has transformed the housing market landscape. As borrowing costs rise, potential homebuyers find themselves reassessing their options, often leading them to consider renting instead of purchasing.

Plus, this shift is further compounded by increasing property prices, making home ownership less accessible for many. Consequently, you may notice an uptick in demand for rental properties, as individuals and families look for affordable living solutions amidst high mortgage rates. This trend suggests a significant shift in how you might approach your housing decisions in today’s market.

The Impact on Homebuying

Some experts believe that rising mortgage rates are significantly shaping the homebuying landscape. As you navigate these changes, it’s crucial to understand how The Impact of Interest Rates on Rental Property Investment could affect your decisions in the rental market.

Affordability Concerns

Homebuying has become increasingly challenging for many individuals due to affordability concerns. As mortgage rates rise, the overall costs associated with purchasing a home can outpace many buyers’ financial capabilities, leading to a reconsideration of their options.

Shifts in Homebuyer Behavior

Between adjusting budgets and reassessing priorities, you may notice significant shifts in homebuyer behavior. Many potential buyers are delaying their purchases, seeking alternative financing solutions, or even opting to rent longer to circumvent the financial strain rising mortgage rates impose.

And as you explore these shifts further, you might come across a trend where buyers are prioritizing stability over ownership. This could lead to an increased preference for properties that offer favorable leasing arrangements or exploring areas with lower housing costs, ultimately reshaping the rental market as a whole.

Implications for the Rental Market

For many individuals and families, rising mortgage rates may lead to significant changes in their housing decisions, making renting more attractive. As potential homebuyers reconsider their options, you might find that the rental market is experiencing notable shifts, with increased demand and evolving pricing strategies. This transformation can impact your own housing choices, whether you are considering renting or remaining in your current residence.

Increased Demand for Rentals

The surge in mortgage rates has made it more difficult for many people to buy homes. As a result, you may notice an increase in demand for rental properties, leading to longer waitlists and higher occupancy rates in many areas. This trend signifies a shift in the market that could affect your own housing experience.

Rent Price Adjustments

Above all, the rising demand for rental properties may prompt landlords to adjust rent prices. You might see an increase in rental costs in your area, as providers capitalize on the growing competition for available units. This adjustment reflects the changing dynamics of the housing market and can affect your budgeting and housing decisions.

Implications of these rent price adjustments can vary widely based on location and market conditions. You may find that some landlords increase their rates significantly, while others may choose to keep rents stable to retain tenants in a competitive landscape. Understanding these factors is crucial for navigating your options, allowing you to make informed decisions about your living arrangements in the current rental market.

Rental Market Trends

Many renters are feeling the impact of rising mortgage rates as they influence rental prices and demand. As potential homebuyers remain on the sidelines, the rental market is witnessing increased activity, particularly in areas where affordability is more favorable. You may find that neighborhoods previously overlooked are becoming more desirable, as individuals seek flexible housing options without the heavy financial commitment of buying a home.

Urban vs. Suburban Dynamics

Across the country, urban areas are experiencing a shift as many residents migrate to suburban locations in search of more affordable living. You might notice this trend reflected in rental prices, with suburban rents rising faster than those in some urban centers. As a renter, this change offers you the chance to explore neighborhoods that align with your lifestyle preferences while still meeting your financial goals.

Market Predictions

Across various regions, experts anticipate that the rental market will continue to evolve due to the ongoing effects of rising mortgage rates. As more people choose to rent, you can expect increased competition and potential price hikes in rental listings. Keeping an eye on neighborhood developments and amenities will be vital for your future rental decisions.

Also, as the rental market adjusts, it’s vital to monitor economic indicators that could shift supply and demand dynamics further. Factors such as job growth, population movements, and changes in consumer preferences will influence rental opportunities in the coming months. You should consider staying informed about these trends to make educated decisions that suit your housing needs and financial situation.

Investor Sentiment

Despite the rise in mortgage rates, investor sentiment remains resilient. Many investors are shifting their focus towards rental properties as a more stable income source. The combination of high mortgage rates and rising rent prices has created a renewed interest in real estate investment, as you consider potential returns and the ongoing demand for rental units.

Changes in Investment Strategies

Around the current landscape, you’ll notice a shift in investment strategies among real estate investors. They are increasingly adopting more conservative approaches, often prioritizing cash flow over capital appreciation. This means you might see more investors considering properties that offer immediate rental income rather than speculative investments that may take longer to yield returns.

Emerging Opportunities

The evolution of the rental market provides unique opportunities for savvy investors looking to capitalize on changing dynamics. As demand for rental properties continues to surge, you can find attractive deals in markets that were previously overlooked. With the right research and timing, you can position yourself to benefit from these emerging trends.

Changes in the economic environment have created niches for you to explore. For instance, areas that experience increased job growth may see higher rental demand, making them prime candidates for investment. Additionally, multifamily housing units and affordable housing developments are becoming increasingly appealing, as they cater to a growing portion of the population seeking rental options. By staying informed and adaptable, you can successfully navigate this evolving market landscape.

Policy Considerations

Now, as mortgage rates rise, various policy considerations are emerging that could influence the rental market. You should be aware that policymakers are weighing options to provide relief for tenants facing increased demand and rising rents. These considerations could involve targeted financial support or incentives for rental property owners to maintain affordability during this economic shift.

Government Response

At this juncture, the government is likely to respond by evaluating current housing policies and considering new measures aimed at stabilizing the rental market. You may see initiatives that not only support renters but also encourage landlords to keep rental prices manageable. These responses would be crucial in bridging the gap between homeownership and rental affordability in light of rising mortgage rates.

Potential Regulatory Changes

About the potential for regulatory changes, you might notice a trend toward more stringent regulations aimed at protecting renters. As rental prices escalate, there is growing interest in policies such as rent control or ties to inflation indices. Such changes could help maintain rental housing affordability as the market evolves.

It is important for you to stay informed about the discussions surrounding these potential regulatory changes, as they could significantly impact your housing decisions. Policymakers may explore various approaches, including enhanced tenant protections or incentives for landlords to offer longer leases at stable rates. Knowing how these regulations might develop can help you navigate the shifting landscape of the rental market effectively.

Conclusion

Considering all points, it’s clear that rising mortgage rates are significantly impacting the rental market. As homeownership becomes less attainable, you may find that more individuals are turning to rental options, driving up demand and potentially rental prices in your area. This shift can affect your investment decisions and the housing landscape, making it vital for you to stay informed about current market trends to navigate these changes effectively.

Q: How have rising mortgage rates impacted the demand for rental properties?

A: Rising mortgage rates have led many potential homebuyers to reconsider or delay their purchase plans, which in turn has increased the demand for rental properties. As borrowing costs soar, individuals who might have otherwise purchased homes are opting to rent instead, pushing up rental prices in many markets. This trend has particularly affected areas where home prices remain high, making rentals a more attractive and feasible option for those facing higher monthly mortgage payments.

Q: Are rental prices likely to continue increasing as mortgage rates rise?

A: While rental prices have seen an uptick due to increased demand, their future trajectory may depend on various factors, including economic conditions and housing inventory levels. If mortgage rates continue to rise, it could further solidify the trend towards renting. However, if the economy slows down or if rental inventories increase significantly, this could be a counterbalance, potentially stabilizing or even lowering rental prices in the medium term.

Q: What should landlords and property investors consider in the current rental market climate?

A: Landlords and property investors should assess the changing dynamics caused by rising mortgage rates. It’s crucial to understand market demand, as increased competition from more renters can open opportunities for investment. Additionally, keeping an eye on local regulations and maximizing marketing efforts can be beneficial. Adjusting rental pricing strategies based on market conditions and tenant needs can help secure stable occupancy rates and maximize revenues amid the ongoing fluctuations in interest rates.