Financial instability can significantly impact your ability to make housing payments, leading you to experience increased strain as a renter or homeowner. During a downturn, job losses, reduced wages, and inflation often force you to stretch your budget further, making it challenging to cover rent or mortgage costs. This blog post will explore the various factors that contribute to financial hardship in a struggling economy and how they specifically affect your housing situation, providing you with insights to navigate these trying times more effectively.

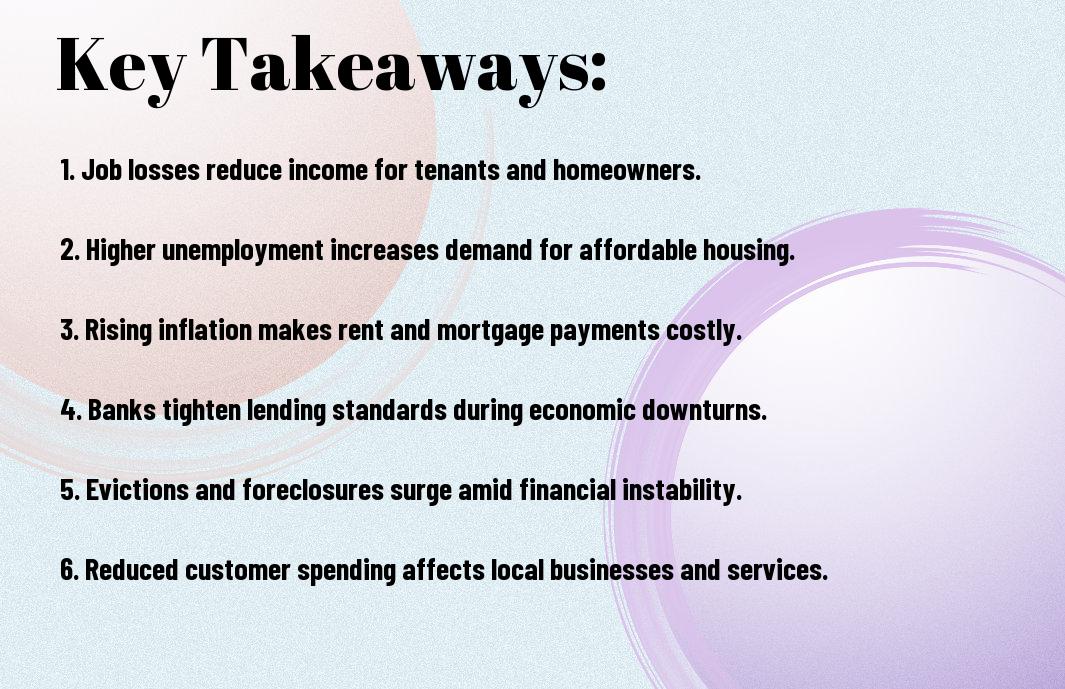

Key Takeaways:

- A bad economy often results in higher unemployment rates, which can lead to a decrease in income for renters and homeowners, making it difficult to meet housing costs.

- As economic conditions worsen, landlords may raise rents to cover their costs, putting additional financial pressure on renters who may already be struggling.

- Homeowners may face challenges with mortgage payments due to reduced income or increased living costs, increasing the risk of foreclosure in a weakened economy.

The Impact of Economic Downturns

For many individuals and families, economic downturns can create significant financial challenges. As the economy weakens, the effects ripple through various sectors, affecting your job security, income stability, and overall living conditions. The strain of decreased financial resources can make it increasingly difficult for you to meet housing costs, leading to greater financial stress for both renters and homeowners alike.

Job Losses and Unemployment Rates

Losses in employment during economic downturns can leave you without income, making it hard to pay your rent or mortgage. As companies downsize or shutter, the unemployment rate rises, and finding a new job becomes more challenging. This lack of job security can directly impact your ability to maintain your housing, further increasing financial strain.

Inflation and Rising Living Costs

On top of job losses, inflation can significantly affect your financial situation. As prices for everyday goods and services climb, your purchasing power decreases. This means you have less money available for imperative expenses like housing, utilities, and food, creating a perfect storm for financial distress.

To understand how inflation compounds your financial strain, consider how rising living costs affect your budget. With basic necessities becoming more expensive, you may find yourself reallocating funds away from rent or mortgage payments, creating potential housing instability. As you navigate these increasing costs, it’s imperative to reassess your spending habits and find ways to adapt to the changing economic landscape to ensure you can maintain your living situation.

Renters’ Financial Strain

Assuming you are a renter, it’s important to recognize how economic downturns can significantly impact your financial stability. In a bad economy, job losses and reduced income levels often lead to a higher rate of evictions and increased competition for affordable housing, putting you in a precarious position as you try to secure and maintain your living situation.

Increased Rent Prices

One of the immediate effects of a troubled economy is the rise in rent prices, as landlords may increase rates to compensate for their losses. This surge can leave you struggling to keep up with higher costs, especially when wages generally do not rise in tandem with rent hikes.

Difficulty in Meeting Monthly Payments

Financial instability can make it increasingly difficult for you to meet your monthly rental obligations. As you face job uncertainty or decreased working hours, the fixed expense of rent becomes more burdensome, leading to tough decisions about how to juggle your financial responsibilities.

Further exacerbating this situation are unexpected expenses that can arise, such as medical bills or car repairs. If you already have a tight budget, these additional financial burdens can push you toward the brink of financial insecurity. Cutbacks on other necessities, such as food or transportation, might become necessary as you prioritize paying your rent, which can create a cycle of stress and instability in your life.

Homeowners’ Challenges

Once again, homeowners find themselves grappling with the burdens of a weakened economy. As financial instability rises, many face difficulties in managing their mortgage payments, making it tougher to uphold homeownership. Decreasing property values and job insecurity can result in stress and uncertainty, leaving you to navigate a landscape where the dream of homeownership feels increasingly fragile.

Mortgage Default Risks

By facing job loss or reduced income, you may find it challenging to make your mortgage payments on time. This situation puts you at risk of mortgage default, which can have significant repercussions on your credit score and financial future. As your financial stability wanes, the threat of foreclosure looms, potentially jeopardizing your home and long-term investments.

Home Maintenance and Repairs Cost

By living in a struggling economy, you may notice that the costs of home maintenance and repairs can become burdensome. Often, unexpected issues arise that require immediate attention, yet financial strain can force you to defer these necessary repairs, leading to more significant problems down the line.

Considering the importance of maintaining your home, any deferred maintenance can exacerbate existing issues, leading to higher repair costs and decreased property value. When your funds are tight, it can be tempting to delay important repairs, but doing so can result in more severe damages that pile additional financial strain on you. It’s important to prioritize repairs and maintenance whenever possible to protect your significant investment in your home.

Government Assistance Programs

After an economic downturn, government assistance programs become vital for renters and homeowners facing financial difficulties. These programs aim to provide relief and can significantly alleviate your financial burden. You can learn more about the potential impact of economic crises on real estate investments in this article on How An Economic Crisis Can Impact Real Estate Investing.

Rental Assistance Initiatives

Along with various assistance programs, rental assistance initiatives are designed to help you cover missed rent payments and keep you in your home during tough economic times. Local and state governments often offer these programs, and it’s worth checking what’s available in your area.

Homeowner Support Options

Beside rental assistance, there are several homeowner support options you can explore to prevent foreclosure or loss of your property. From mortgage forbearance to low-interest loans, these programs can ease your financial strain during difficult periods.

In fact, many mortgage providers have implemented forbearance options that allow you to temporarily pause or reduce your mortgage payments. Additionally, some states offer relief funds aimed at helping homeowners make their payments, ensuring that you can focus on recovering financially without the looming threat of losing your home.

Long-term Consequences of Economic Declines

Unlike periods of economic growth, a downturn can have lasting impacts on your financial situation and overall well-being. Economic declines often lead to reduced job security and lower wages, which can affect your ability to meet rent or mortgage obligations. As your financial concerns grow, you may experience heightened stress and uncertainty about your housing stability, making it harder to plan for the future.

Decreased Housing Stability

On the surface, dwindling economic conditions can undermine your ability to maintain a stable living situation. As job opportunities diminish and income fluctuates, you may find it increasingly difficult to cover monthly housing costs, plunging you into a cycle of insecurity. This precariousness not only affects your mental health but can also lead to a reluctance to invest in home improvements or make long-term housing plans.

Increased Eviction Rates

On average, economic downturns correlate with a rise in eviction rates, significantly impacting renters and homeowners alike. As financial strain becomes prevalent, many individuals struggle to keep up with their rent or mortgage payments, leading to heightened risk of losing their homes.

Due to rising unemployment and stagnant wages during economic downturns, many tenants are unable to fulfill their financial obligations. This often results in landlords pursuing evictions to recover losses, further contributing to housing instability in your community. As more families face eviction, the knock-on effects on mental health, stability, and overall quality of life can be profound, making it important to address the broader economic factors at play.

Strategies for Renters and Homeowners

All individuals facing financial strain due to a poor economy must adopt proactive strategies to mitigate the impact on their housing situations. Whether you’re a renter or a homeowner, understanding effective approaches can help you maintain stability during economic uncertainty. By exploring budgeting techniques, alternative housing solutions, and available assistance programs, you can better navigate financial challenges and preserve your living situation.

Budgeting and Financial Planning

Budgeting is an vital tool that helps you track your income and expenses, allowing you to identify areas where you can cut back. By creating a realistic budget, you can prioritize necessary expenditures like rent or mortgage payments while finding ways to reduce discretionary spending. Regularly reviewing your financial plan enables you to adapt to changing circumstances, ensuring your housing costs remain manageable.

Seeking Alternative Housing Solutions

Financial challenges may require you to explore alternative housing solutions to lessen your burden. This could involve considering smaller rental units or moving to neighborhoods with lower costs. Additionally, you may want to look into temporary housing arrangements such as subletting, house-sharing, or even staying with family to alleviate immediate financial pressures.

A key strategy in seeking alternative housing solutions is to remain open-minded and flexible. Consider reviewing your current living situation and assessing whether it truly meets your needs. Researching different areas, speaking to local real estate agents, or utilizing online platforms can open up options you may not have previously considered. Engaging in conversation with your landlord about potential adjustments to your lease or rent can also lead to negotiable solutions that suit both parties during tough times.

Conclusion

With this in mind, you can see how a bad economy impacts financial strain for both renters and homeowners. Job losses, reduced wages, and increased living costs can lead to difficulty in meeting housing expenses. As demand for affordable housing rises, rental prices may soar, intensifying your financial burden. Additionally, homeowners may face declining property values, making it harder to manage mortgage payments. Understanding these dynamics enables you to make informed decisions to adapt to challenging economic conditions.

Q: How does a bad economy impact employment opportunities for renters and homeowners?

A: In a bad economy, businesses often face declining sales and revenues, leading them to cut costs—in many cases, this involves reducing their workforce. High unemployment rates can result in individuals losing their jobs or facing reduced hours, making it challenging for renters and homeowners to meet their monthly obligations. As income diminishes or becomes unstable, the pressure to pay rent or mortgage payments increases, leading to heightened financial strain.

Q: How does inflation affect the cost of living for renters and homeowners during economic downturns?

A: During economic downturns, inflation can lead to rising costs of vital goods and services, such as groceries, utilities, and transportation. Increased living expenses can strain the budgets of renters and homeowners, forcing them to allocate a larger portion of their income to basic needs, leaving less available for housing costs. This shift can make it more challenging to keep up with rent or mortgage payments, further exacerbating financial strain.

Q: What role does decreased housing supply play in financial strain for renters and homeowners during a bad economy?

A: In a bad economy, there may be a slowdown in new housing construction due to reduced investment and uncertainty in the market. This decreased supply can lead to higher demand for existing rental properties, pushing rental rates up. For homeowners, declining property values combined with rising demand can result in challenges if they need to refinance or sell their homes. Both scenarios can create financial pressure, as renters may struggle to find affordable housing, and homeowners may find themselves in precarious situations concerning their property value and debt obligations.