It’s important to understand how fluctuating mortgage rates can impact new home construction. As a potential buyer or investor, your decisions may be influenced by these rates, affecting everything from housing demand to construction costs. In this post, we’ll explore the various ways mortgage rates shape the landscape of new home building, ensuring you are well-informed as you navigate today’s market.

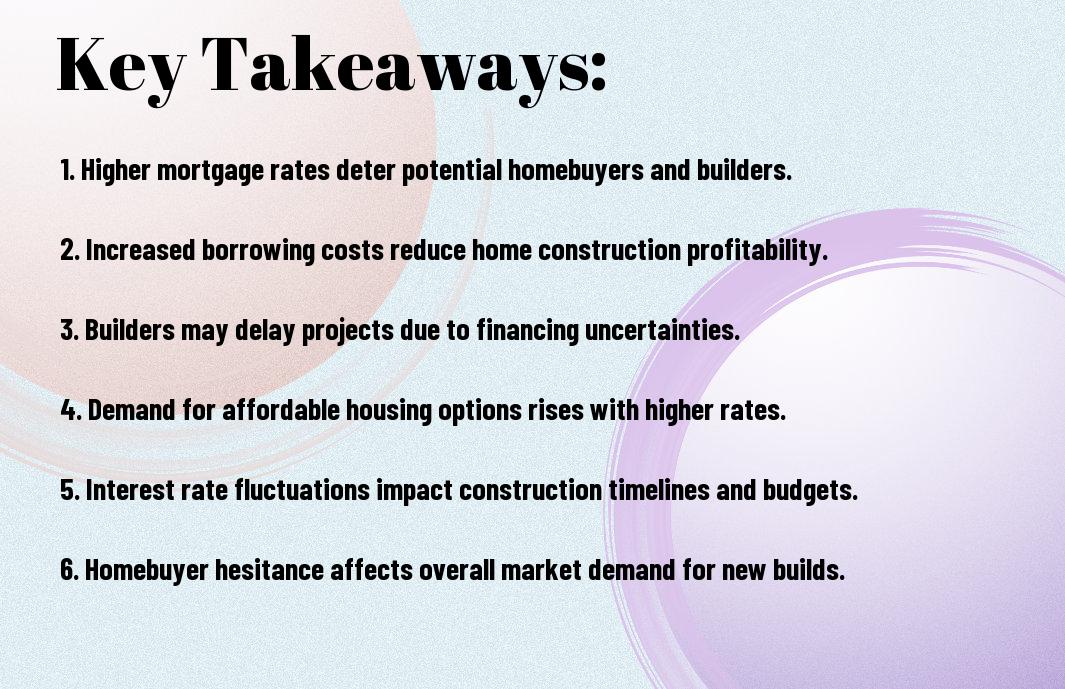

Key Takeaways:

- Higher mortgage rates generally lead to decreased affordability for potential homebuyers, which can reduce demand for new homes and slow down the pace of new construction.

- Builders may adjust their strategies in response to rising mortgage rates, such as focusing on more affordable housing options or delaying projects until rates stabilize.

- The overall economy can also be impacted, as fewer new homes being built can affect job creation in construction and related industries, potentially leading to broader economic slowdowns.

Overview of Mortgage Rates

Before delving into how mortgage rates influence new home construction, understanding what mortgage rates are and how they fluctuate is necessary. These rates determine the cost of borrowing money to purchase a home and can greatly impact your overall investment. Variations in these rates can influence your buying power and the decisions of builders in the housing market.

Definition and Factors Influencing Rates

For clarity, mortgage rates are the interest percentages lenders charge on home loans, influenced by various factors including:

- Federal Reserve policies

- Inflation levels

- The economy’s overall performance

- Your credit score and financial history

Knowing these factors can help you make informed decisions regarding your home financing options.

Historical Trends in Mortgage Rates

Definition of historical trends in mortgage rates involves looking at how rates have changed over time. Your understanding of these trends can guide you in making better financial decisions, especially during periods of higher or lower rates.

It is noteworthy that mortgage rates have experienced significant fluctuations over the decades. You might find that rates were much higher in the 1980s, often exceeding 10%, compared to the relatively low rates experienced in recent years. Tracking these shifts can help you predict future trends and understand the best timing for your home purchase or construction endeavor.

Impact on Homebuyer Behavior

The fluctuations in mortgage rates directly influence your homebuyer behavior, shaping your decisions in the market. When rates rise, you may feel the pressure to act quickly, fearing further increases, while lower rates can inspire you to explore more options. Ultimately, these changes affect how you navigate the buying process, impacting both urgency and choice.

Affordability and Purchase Decisions

Among the many factors influencing your home purchase, affordability remains paramount. Higher mortgage rates can reduce your purchasing power, leading you to reassess your budget and the type of properties you can afford. This shifting landscape often compels you to make difficult compromises regarding location, size, and features of the home you desire.

Demand for New Construction

Homebuyer interest in new construction tends to vary with mortgage rate trends. When rates rise, you might find existing homes more appealing, shifting your focus away from new builds. Conversely, lower rates can make new construction more desirable, as they often come with modern features and energy-efficiency benefits that resonate with your long-term goals.

Consequently, the overall demand for new construction can fluctuate significantly based on mortgage rates. As you evaluate your options, rising rates may lead you to prefer established neighborhoods over new developments, while falling rates could reignite interest in freshly built homes. Builders and developers closely monitor these trends, adjusting their strategies to align with your preferences as a buyer.

Influence on Homebuilder Confidence

To understand how mortgage rates impact new home construction, you need to consider their effect on homebuilder confidence. When mortgage rates rise, builders may feel less optimistic about the housing market. This diminished confidence can result in fewer new projects and a more cautious approach to development, ultimately affecting the availability of new homes in your area.

Builder Sentiment and Economic Indicators

Before making decisions, builders often assess economic indicators, including mortgage rates, to gauge market trends. When rates are high, you might notice a decline in builder sentiment reflecting worries about potential buyer hesitance. This, in turn, can affect the overall pace of new home construction projects, as companies may choose to hold off investing in new developments.

Adjustments in Construction Plans

Sentiment shifts in response to changing mortgage rates can lead to significant adjustments in construction plans. Builders may revise their timelines or project scopes, which can affect everything from the scale of new developments to the types of homes being constructed.

Plus, when you see builders adjusting their construction plans, it often signals that they are adapting to current market conditions. This might include scaling back on large projects or pivoting to more affordable housing options to attract buyers sensitive to higher mortgage rates. Such adjustments are crucial for surviving in a fluctuating market and will ultimately shape the landscape of home availability in your community.

Regional Variations in Construction Activity

Not all regions experience the same impact from fluctuating mortgage rates. In some areas, the construction of new homes remains resilient, while others may see a sharp decline in activity. Factors such as local demand, housing inventory, and economic conditions create a varied landscape across the country, ultimately influencing construction trends significantly.

Comparing Markets with Different Rate Environments

With various markets facing different mortgage rate conditions, understanding these dynamics is key. The table below outlines how these environments may influence construction activity.

Impact of Rate Environments on Construction

| Low Rate Environment | Increased new home construction |

| High Rate Environment | Decreased new home construction |

Local Economic Factors Supporting Growth

The local economy heavily influences new home construction, as several factors can encourage this growth. You may find that rising employment rates, a growing population, and increased wages attract developers and buyers alike.

- Strong job market

- Population influx

- Improved infrastructure

The comprehensive health of these local economies directly correlates with the demand for new housing. As conditions improve, you can anticipate a boost in construction initiatives to meet this demand.

- Increased consumer confidence

- Investment in community resources

- Supportive local policies

To navigate these factors effectively, consider assessing local economic conditions regularly. This proactive approach can help you stay ahead of market shifts and optimize your decisions regarding new home construction.

Financing Challenges and Opportunities

Once again, you’ll find that fluctuating mortgage rates present both challenges and opportunities for potential homebuilders. As rates rise, affordability becomes a significant concern, which may deter some buyers from moving forward with new constructions. However, with rates creating a diverse landscape, savvy builders and buyers can capitalize on lower interest rate moments to secure favorable financing options that support their construction goals.

Financing Options for New Home Construction

Along your journey in new home construction, exploring various financing options is important. Conventional loans, FHA loans, and private financing can all play unique roles in funding your project. Understanding which options align with your financial situation and construction timeline allows you to make informed decisions, ultimately paving the way for successful homebuilding.

Role of Government Policies in Mitigating Effects

About the impact of government policies, these regulations and initiatives can greatly influence your financing landscape. Policymakers often introduce measures aiming to stabilize the housing market and make homebuilding less problematic amidst shifting mortgage rates. Through tax breaks, low-interest loans, or incentives for sustainable building methods, government actions can provide necessary support to mitigate financing challenges.

Indeed, government policies play a pivotal role in shaping the conditions under which new home construction takes place. By offering incentives such as grants or subsidies for building, these initiatives can significantly reduce financial burdens associated with rising mortgage rates. Additionally, programs aimed at increasing access to affordable financing can empower first-time homebuyers to take the leap into new construction, ensuring that you have viable pathways to turn your building dreams into reality. By staying informed about these policies, you can strategically navigate the financing landscape and take advantage of available support.

Future Projections for Mortgage Rates and Construction

After analyzing current trends, experts predict that mortgage rates may fluctuate, affecting new home construction. As you navigate this dynamic market, be sure to understand the impact of today’s changing interest rates on …. A rise in rates could slow down construction activity as builders and buyers reassess their plans.

Expert Opinions on Upcoming Trends

Between various economic indicators and expert insights, you may find that projections for mortgage rates could influence home builder sentiment. Some analysts suggest that rates may stabilize, encouraging construction, while others warn of potential upward pressures that could dampen the market.

Potential Changes in Market Dynamics

Potential shifts in market dynamics may lead to a more competitive landscape among builders and buyers. As you consider purchasing a new home, you should be aware that fluctuations in mortgage rates could prompt changes in supply and demand, impacting pricing and availability.

Even subtle shifts in mortgage rates can significantly alter buyer confidence and builder strategies. As you stay informed about the market, understanding the potential implications of these changes allows you to make well-informed decisions regarding your home investment. Keeping an eye on economic reports and expert analyses is imperative for anticipating how these dynamics may evolve.

Conclusion

So, as you explore the landscape of new home construction, understanding how mortgage rates impact your decisions is important. Fluctuating rates can influence not only your purchasing power but also the overall demand for new homes. When rates rise, it often leads to increased costs that may deter potential buyers, directly affecting builders’ incentives to start new projects. Staying informed on these trends will help you navigate the housing market more effectively, ensuring you make sound investments for your future.

Q: How do rising mortgage rates impact the demand for new homes?

A: When mortgage rates increase, the affordability of purchasing a home tends to decrease for many prospective buyers. Higher rates mean higher monthly payments, which can push some individuals and families out of the market or lead them to seek less expensive options. This reduced demand for new homes can result in builders slowing down construction, as fewer buyers can afford to purchase newly built properties. Consequently, this can lead to a slowdown in the overall housing market.

Q: What effects do mortgage rates have on home builder investment decisions?

A: Home builders often monitor current mortgage rates closely when deciding how many new homes to construct. If rates are high, builders may become more conservative with their investments, opting to delay or reduce the number of new projects they undertake. Additionally, higher borrowing costs can limit builders’ budgets, making it more difficult for them to finance new developments. In contrast, lower mortgage rates can inspire confidence and lead to increased investment in new home construction.

Q: How do changes in mortgage rates influence the pricing of new homes?

A: Fluctuations in mortgage rates can significantly influence how new homes are priced. When rates rise, builders may need to adjust their pricing strategies to attract buyers who are facing higher financing costs. This could mean offering discounts or lowering prices to encourage sales. Meanwhile, if mortgage rates decrease, builders might maintain or even increase prices, as lower rates can stimulate demand, allowing them to capitalize on a more favorable market for housing purchases.