Many homeowners may wonder how economic downturns impact the value of their properties. In a struggling economy, factors such as job losses, decreased consumer spending, and rising interest rates can contribute to a decline in housing prices. This blog post will explore the various ways that your home’s value can be affected during tough economic times and provide you with insights on how to navigate these challenges to protect your investment.

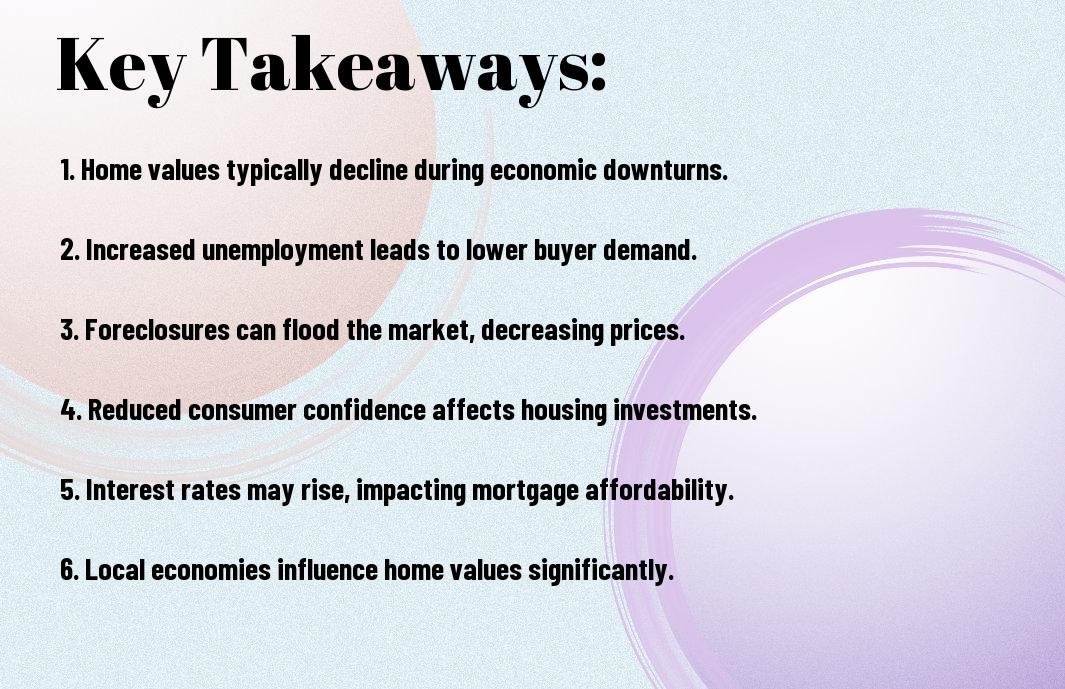

Key Takeaways:

- Home values typically decline during a bad economy due to increased unemployment and decreased consumer spending, leading to lower demand for homes.

- Foreclosures and distressed sales can flood the market, further driving down property values and negatively impacting homeowners in the area.

- Homeowners may face challenges in refinancing mortgages or selling their property, as banks tighten lending criteria and potential buyers become more cautious.

Understanding Home Values

A home’s value is influenced by various factors, including location, condition, and market trends. When the economy suffers, homeowners may find their property values declining, making it necessary to understand how these elements interplay. By keeping a pulse on your local market, you can better navigate the impact of economic shifts and take proactive measures to protect your investment.

Factors Influencing Home Prices

On your journey to understanding home values, several factors come into play, including:

- Location and neighborhood appeal

- Supply and demand dynamics

- Interest rates and financing options

- Condition and age of the property

Thou must stay aware of these factors to assess the real value of your home.

The Role of Economic Indicators

For homeowners, economic indicators such as unemployment rates, inflation, and consumer confidence provide insight into the health of the housing market. Tracking these metrics helps you gauge potential changes in property values, allowing for informed decision-making regarding buying or selling your home.

But it’s important to recognize that these indicators can be unpredictable. They fluctuate based on broader economic conditions, and even minor shifts can result in significant variations in home values. Monitoring these trends and understanding their implications will empower you to make strategic choices, ensuring your home remains a valuable asset in any market scenario.

Impact of a Bad Economy on Homeowners

Even in a flourishing market, homeowners must stay alert to the effects of an economic downturn. A bad economy can lead to diminished property values, limited buyer interest, and potential challenges when it comes to selling your home. Understanding these dynamics is imperative for making informed decisions about your real estate investments during tough times.

Decreased Demand for Homes

An economic downturn typically results in decreased buyer confidence, leading to diminished demand for homes. With financial uncertainty looming, many potential buyers may choose to delay purchasing a home or may be unable to secure financing. This decline in demand can put additional pressure on home values.

Increasing Foreclosure Rates

Between rising unemployment and financial instability, homeowners often find themselves facing foreclosure risks. As more individuals struggle to keep up with mortgage payments, foreclosure rates tend to increase, flooding the market with distressed properties. This can significantly depress home values in your neighborhood, further impacting your investment.

Homeowners experiencing difficulties may find themselves in a precarious situation while trying to maintain their property. More foreclosures can create a cycle where neighboring properties also lose value, leading to a challenging landscape for sellers. If you’re facing financial hardships, seeking assistance early can help you navigate these tough times while preserving your home’s equity.

The Psychology of Homebuyers in a Recession

Your emotional response to economic downturns greatly influences your decision-making as a homebuyer. In a recession, fear and uncertainty can dominate the market, affecting how buyers perceive their options. As a homeowner, understanding these psychological shifts can help you navigate the complexities of buying or selling a home in challenging economic times.

Consumer Confidence and Housing Prices

Against the backdrop of a recession, consumer confidence often plummets, leading to diminished demand for housing. Homebuyers may hesitate to make significant financial commitments, which in turn can cause home prices to stagnate or decline. As a homeowner, watching these trends is imperative for making informed decisions in a fluctuating market.

Perception of Value and Market Trends

Behind the figures and statistics lies the subjective nature of value perception. During economic downturns, buyers often become more cautious, searching for bargains or undervalued properties. This shift can lead to a reluctance to pay asking prices, further impacting the housing market dynamics.

Understanding how buyers perceive value during a recession is vital for homeowners. Your property’s worth may be evaluated through a different lens, as potential buyers prioritize affordability and long-term stability. This trend can lead to prolonged listing periods and pressure on prices, urging you to stay attentive to the shifts in market demand and buyer sentiment. By aligning your expectations with current perceptions of value, you can better position your home in a competitive landscape.

Strategies for Homeowners to Protect Their Investments

Many homeowners can utilize several strategies to safeguard their investments during a bad economy. By staying proactive and informed, you can adapt your approach to protecting your home’s value. This involves careful financial planning, making informed decisions, and considering alternative methods to increase your property’s overall worth. Creating a solid strategy now can help you weather the economic storm effectively.

Home Improvements and Value Preservation

Between market fluctuations and economic uncertainties, making strategic home improvements is necessary for maintaining your property’s value. Focus on upgrades that yield a high return on investment, such as kitchen remodels, bathroom updates, and energy-efficient installations. Staying attentive to these improvements can help you enhance your home’s appeal and ultimately safeguard its worth in the long run.

Refinancing Options in a Bad Economy

Below market interest rates may present homeowners with refinancing opportunities that can lower monthly payments, reducing financial strain. By refinancing, you can potentially consolidate debt or access equity for needed expenses. It’s important to evaluate your current situation and determine if this route aligns with your financial goals and needs.

Also, when considering refinancing options, review your credit score and ensure it meets lender requirements. Analyze various lenders to find the best rates and terms that suit your financial strategy. If you’re planning to stay in your home long-term, refinancing can provide stability and relief during challenging times, making it a valuable option to explore.

Local Market Variations

Despite the overall economic downturn, local market variations can significantly influence your home’s value. Areas with higher demand may see prices holding steady or even rising, while others might experience declines. For an in-depth understanding of how a recession might affect home values, check out How Would a Recession Impact Home Value? The Silver….

Geographic Influences on Home Values

Between coastal cities and rural areas, geographic influences play a key role in determining home values. Regions with desirable amenities, strong job markets, or good schools tend to maintain their property values better than others, even during economic hardships.

Urban vs. Rural Trends

One trend to observe is the disparity between urban and rural home values. While urban areas may experience more fluctuations, rural regions can often provide more stability amid changing economies.

This distinction is important for you to consider when assessing your home’s value. Urban areas often face pressures like increased inventory and declining demand, which can lead to reduced prices. Conversely, rural properties may benefit from a steady demand, particularly as people seek more space and a quieter lifestyle. Understanding these trends can empower you to make informed decisions regarding your home and its value in the current market climate.

Long-Term Effects of Economic Downturns

Unlike temporary market fluctuations, economic downturns can leave lasting impacts on your home’s value. Over time, property values may remain stagnant or decline further due to decreased demand, foreclosures, and buyers’ reluctance to invest in a shaky market. The neighborhood’s overall economic status can also influence how quickly your property recovers, leaving you with potential challenges when you aim to sell or refinance your home.

Historical Performance of Housing Markets

Any analysis of housing markets reveals that they often experience cycles of growth and decline, particularly during economic downturns. Historical data shows that home values may drop significantly during recessions, but they typically recover over time as the economy stabilizes. Understanding this pattern can help you navigate your investment with a long-term perspective.

Recovery Patterns Post-Recession

The recovery of housing markets following a recession varies, influenced by factors such as government policies, interest rates, and local economic conditions. It might take years for home values to regain their pre-recession levels, and consistent demand is vital for a healthy recovery. The pace of recovery can significantly impact your decision to hold onto your property or consider selling.

This recovery phase often sees home values rising gradually, driven by positive economic indicators such as job growth and increased consumer confidence. Your location and the specific characteristics of your home also play crucial roles in determining how quickly values rebound. Staying informed about market trends and local developments can better prepare you for when the market turns in your favor, allowing you to make informed decisions about your property.

To wrap up

Following this, it’s important for you to understand that in a bad economy, your home value can be significantly impacted by factors such as unemployment rates, interest rates, and overall housing demand. As these elements fluctuate, your property’s worth may decline, potentially affecting your equity and resale potential. By staying informed and considering market trends, you can make informed decisions regarding your home investment, ultimately helping you navigate the challenges of a down economy effectively.

Q: How does a bad economy impact home values for homeowners?

A: In a bad economy, home values often decline due to several factors. Decreased demand for housing leads to lower sale prices as fewer buyers are willing or able to purchase homes. Economic struggles can lead to job losses, wage stagnation, and increased foreclosures, all of which contribute to a surplus of homes on the market. This oversupply typically results in further depreciation in home values over time. As a result, homeowners may experience a reduction in their home’s equity, making it challenging to sell or refinance.

Q: Can a homeowner take any steps to protect their home value during an economic downturn?

A: Homeowners can take several proactive measures to help protect their home values during challenging economic periods. Maintaining the property through regular upkeep and improvements can enhance appeal and deter significant drops in value. Additionally, staying informed about local housing market trends allows homeowners to make informed decisions about selling or refinancing. Building positive relationships within the community can also bolster neighborhood value, as well-kept areas are less likely to see dramatic price declines. Finally, homeowners can secure steady employment or additional income sources to better manage mortgage obligations and avoid foreclosure.

Q: How do foreclosures in a community influence local home values?

A: Foreclosures can significantly impact local home values, leading to widespread declines. When homes are foreclosed, they often sell at lower prices, which can set a negative precedent for the surrounding properties. Appraisals of nearby homes may decrease due to the lowered sale prices of foreclosed properties, even if those homes are in better condition. This creates a ripple effect, resulting in potential buyers being less willing to pay higher prices for homes in areas with high foreclosure rates. Consequently, homeowners may face diminished property values, which can also lead to increased financial stress within the community.