Economy fluctuations have a significant impact on your housing situation, whether you are a renter or a homeowner. You may find yourself grappling with rising rents, increased mortgage rates, or diminished property values, altering your financial landscape. Understanding how a downturn influences the market can help you navigate challenges, protect your investments, and make informed decisions in these uncertain times. This post will explore the various consequences of a bad economy on your housing choices and what you can do to mitigate risks.

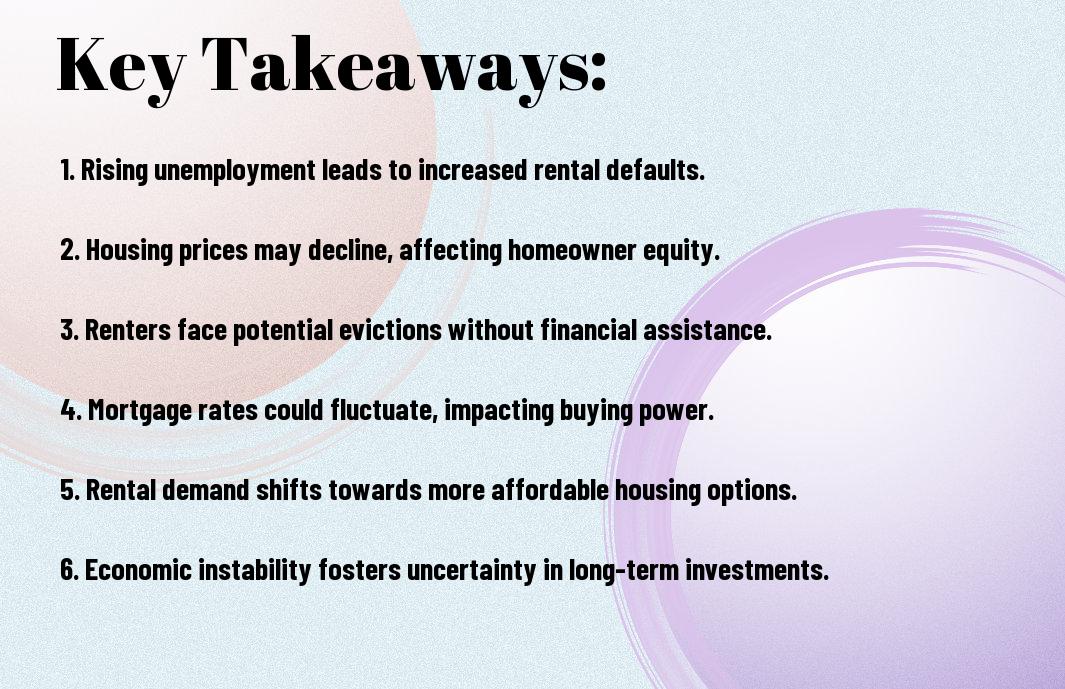

Key Takeaways:

- In a bad economy, renters may face increasing financial strain due to job losses or reduced incomes, making it harder to meet rent obligations.

- Homeowners could experience decreased property values, potentially leading to lower equity and challenges in refinancing or selling their homes.

- Both renters and homeowners may encounter stricter rental and mortgage lending standards, limiting their options in the housing market during economic downturns.

Economic Overview

Your understanding of the economic landscape is vital as it shapes the realities faced by both renters and homeowners today. With shifts in job markets, inflation rates, and overall consumer confidence, economic trends directly influence housing demand, rental prices, and mortgage rates. In uncertain times, knowing how these factors interconnect can help you make informed decisions regarding your living situation and financial plans.

Current Economic Trends

An analysis of current economic trends reveals a mixed bag of opportunities and challenges for renters and homeowners alike. As interest rates fluctuate and employment rates change, you may find it more difficult to secure favorable rental agreements or mortgages. The dynamics of supply and demand are changing rapidly, affecting your housing decisions.

Inflation and Its Impacts

Any increase in inflation can significantly impact your financial stability as a renter or homeowner. With rising costs of goods and services, you may notice higher rental prices and increased mortgage rates, making it more challenging to afford housing.

Even a modest uptick in inflation can have a cascading effect on your monthly budget. As living costs rise, landlords may pass on the additional expenses to you through increased rent, forcing you to allocate more of your income towards housing. Homeowners face similar pressures, as their monthly mortgage payments may rise, either directly through variable interest rates or indirectly through higher property taxes and maintenance costs. The impact of inflation can ripple across your financial landscape, positioning you in a tighter economic corner.

Effects on Renters

There’s no denying that a bad economy can have significant impacts on renters like you. As discussed in 4 Key Factors That Drive the Real Estate Market, economic downturns can lead to increased uncertainty in rental markets, often resulting in higher costs and unstable housing situations.

Rising Rent Costs

About rent prices can surge during economic downturns, forcing you to allocate a larger portion of your income to housing. This financial strain can limit your ability to save, invest, or meet other crucial expenses, creating a ripple effect on your overall financial health.

Housing Stability Challenges

Rising challenges related to housing stability can create an unstable environment for you as a renter. Job losses, reduced hours, or wage cuts may lead to difficulties in making timely rental payments, causing anxiety about potential eviction or homelessness. This instability can be further exacerbated by landlords who might increase rent to cover their own losses, making it harder for you to secure affordable housing options.

Renters facing these challenges are often caught in a cycle of uncertainty and vulnerability. The pressure to keep up with rising costs can push you to downsize or relocate, disrupting your community ties and personal stability. Additionally, the fear of eviction looms large, affecting your mental well-being and overall sense of security in your living situation.

Effects on Homeowners

All homeowners face varying challenges during a bad economy. Lower property values, increased difficulty in selling homes, and tighter lending practices can all weigh heavily on your finances. Furthermore, homeowners may experience a heightened sense of financial insecurity, impacting their ability to make decisions about their investments, home improvements, and long-term plans.

Property Values and Market Dynamics

By understanding that bad economic conditions can lead to a decline in property values, you can better prepare for potential impacts on your home’s worth. As demand for housing wanes and foreclosures rise, the market becomes saturated, decreasing home prices. This situation makes it harder for you to sell your property without taking a loss or to refinance your mortgage at favorable rates.

Mortgage Rates and Affordability

Affordability becomes a significant concern when economic instability causes mortgage rates to rise. As costs increase, your monthly payments may exceed your budget, forcing you to reconsider your housing options or make sacrifices elsewhere in your finances.

A higher mortgage rate can limit your purchasing power when considering a new home, as it affects your monthly payments and overall long-term financial health. You may also find yourself unable to refinance an existing mortgage, missing out on lower rates that could ease monthly financial pressure. Staying informed about market trends and adjusting your budget accordingly can help you navigate these challenges more effectively.

Rental Market Response

To understand the rental market’s response to a bad economy, it’s important to consider how the demand fluctuates alongside financial instability. When job loss and reduced income levels occur, many individuals and families may downsize or search for more affordable housing options, resulting in shifts in rental demand that landlords must address. Your awareness of these trends can help you make informed decisions as a renter or homeowner in this challenging market.

Changes in Rental Demand

With economic downturns, rental demand tends to decrease as potential renters face uncertainty and financial strain. Many individuals may delay moving out on their own or seek out cheaper housing, impacting the overall rental market dynamics. You might find that in today’s climate, the competition for affordable housing intensifies, putting pressure on landlords and influencing rental rates.

Policy Responses and Solutions

Changes in governmental policies can significantly affect rental markets during tough economic times. Property owners and local governments may implement solutions such as rent control measures, emergency rental assistance, and eviction moratoriums to address housing stability concerns. As you navigate these developments, staying informed about local policies and support resources can benefit your situation, whether you are renting or owning property.

Also, recognizing the importance of rental assistance programs and community resources can empower you during a challenging economic period. You may have access to financial aid or housing counseling services that can alleviate some burdens. Understanding these options helps you to advocate for yourself and explore ways to maintain housing security through difficult financial challenges.

Homeownership Challenges

For many aspiring homeowners, navigating a bad economy can present significant challenges. Rising interest rates, inflation, and uncertainty about future financial stability can make it difficult for you to secure funding for a new home. This environment not only affects your buying power but also amplifies the issues of affordability in today’s housing market, pushing many potential buyers to delay their dreams of homeownership.

Barriers to Entry for New Buyers

Beside the general economic instability, you face increased barriers to entry as a new buyer. Lenders often tighten qualifications during downturns, requiring higher credit scores and larger down payments. Additionally, with rising property prices, the financial strain can be overwhelming, making it challenging for you to save enough for a comfortable purchase.

Impact on Existing Homeowners

Buyers may find themselves at a disadvantage in a bad economy, as existing homeowners are often reluctant to sell. This leads to limited inventory, causing home prices to remain high. If you are an existing homeowner, you might feel trapped in your current mortgage, facing a drop in your home’s value while still needing to manage high-interest rates and economic uncertainties.

Barriers to selling your home can leave you in a precarious situation, particularly if you need to move for work or family. A decrease in equity, coupled with increased maintenance costs in an increasingly expensive market, creates stress and challenges for you as an existing homeowner. You may also find it difficult to find a suitable replacement property, leading to uncertainty in your future housing plans.

Regional Variations

After evaluating the economy, it’s important to recognize that regional variations can greatly influence how both renters and homeowners are affected. Different areas may experience economic downturns in unique ways, leading to varying rental prices, job stability, and housing availability in urban and rural settings. Understanding local market conditions can help you navigate your situation more effectively.

Urban vs. Rural Areas

Behind the facades of urban and rural life lies a complex relationship with the economy. Urban areas tend to see more inflation in housing costs, which can strain renters and homeowners alike, while rural areas may experience a slower adjustment of property values. Your housing choices may be impacted differently based on the environment you reside in.

State-Specific Trends

Any assessment of the housing market would be incomplete without considering state-specific trends. Different states may implement distinct economic policies, social programs, and even tax incentives that can influence rental prices and homeownership rates significantly. This variability means that your renting or buying decisions should be informed by the latest local market insights.

Indeed, trends can change rapidly due to factors such as population growth, economic development, and local legislation. For instance, some states may offer robust incentives for homebuyers, while others could face housing shortages that drive up prices. Staying informed about these trends in your state not only aids in making better decisions but also helps you understand the long-term implications for your financial health as a renter or homeowner.

Final Words

The impact of a bad economy on renters and homeowners in today’s market can significantly affect your financial landscape. Rising unemployment and inflation may lead to increased rent prices, making it harder to secure affordable housing. If you own a home, falling property values could jeopardize your investment, while higher mortgage rates may constrain your ability to refinance. You need to stay informed and consider strategic options to navigate these challenges effectively, whether that means seeking more affordable housing options or reevaluating your homeownership goals.

FAQ

Q: How does a bad economy impact rental prices for tenants?

A: In a bad economy, rental prices can fluctuate significantly. Many landlords may reduce rent to attract tenants, leading to lower rental costs in some cases. However, if demand for housing exceeds supply, prices may remain stable or even rise. Additionally, economic downturns often lead to an increase in unemployment, which can result in more individuals seeking affordable rental options, thus increasing competition among renters. Overall, tenants may find both challenges and opportunities during economic downturns, depending on regional market conditions.

Q: What challenges do homeowners face in a struggling economy?

A: Homeowners may encounter several obstacles in a struggling economy. One of the primary issues is the potential decrease in property values, which can make it difficult to sell a home without incurring losses. Additionally, homeowners may experience job instability or income reductions, making mortgage payments more challenging. This scenario can lead to an increase in foreclosures if homeowners cannot keep up with their financial obligations. For some, it may be necessary to explore refinancing options or seek assistance programs to manage their financial situation effectively.

Q: How can renters and homeowners protect themselves during a bad economy?

A: To safeguard their interests, renters and homeowners can take several proactive measures. Renters should focus on budgeting to manage expenses effectively, and explore alternative housing options if rent becomes unaffordable. It can also be beneficial to establish a good relationship with landlords to negotiate terms or discuss potential rent reductions. For homeowners, maintaining an emergency fund to cover mortgage payments in case of job loss can be vital. Keeping an eye on the real estate market and seeking counsel regarding refinancing or selling may also provide strategic advantages during economic downturns.