Selling your home can be significantly impacted by fluctuations in mortgage rates. When rates are low, more buyers typically enter the market, eager to take advantage of affordable financing, which can facilitate a quicker sale. Conversely, higher rates may deter potential buyers, leading to longer selling times as the market cools. Understanding how these rates affect demand can help you strategize effectively, ensuring your home is priced right and marketed efficiently to attract motivated buyers in today’s real estate environment.

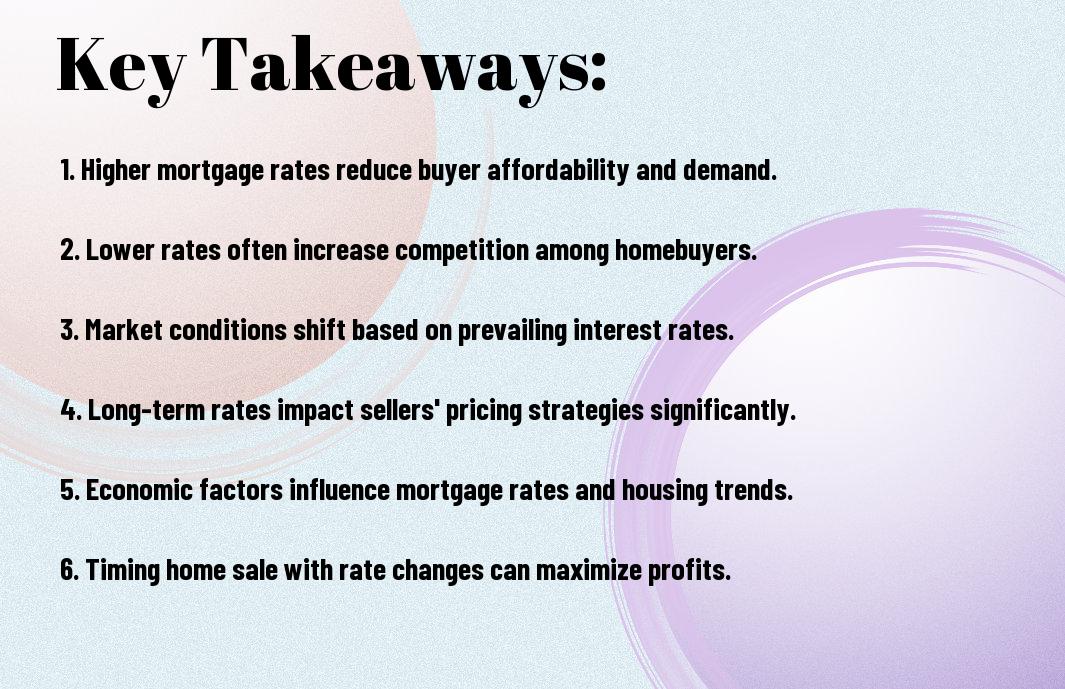

Key Takeaways:

- Lower mortgage rates generally increase buyer affordability, leading to a quicker sale of homes as more potential buyers enter the market.

- Higher mortgage rates can lead to decreased buyer interest and slower sales, as prospective buyers may be priced out or hesitant to commit to a higher monthly payment.

- The overall economic environment and housing market conditions, alongside mortgage rates, also play a significant role in determining how long a home stays on the market.

Understanding Mortgage Rates

To grasp how mortgage rates can affect the real estate market, it’s imperative to understand what they are and how they function. Mortgage rates are the interest costs you incur when borrowing money to purchase a home. These rates fluctuate based on various factors and can significantly influence both home affordability and market activity, impacting how quickly you can sell your property.

Definition of Mortgage Rates

After learning the basics, it’s important to recognize that mortgage rates represent the cost of borrowing money from a lender to buy a home. These rates are expressed as a percentage and can vary based on multiple factors, including your credit score and market conditions. Understanding this definition helps you navigate the complexities of home financing and its effect on selling timelines.

Factors Influencing Mortgage Rates

Around the globe, several key elements can sway mortgage rates. Some of the foremost factors include:

- Inflation levels

- Economic growth indicators

- The Federal Reserve’s interest rate policies

- Your credit score and financial profile

This interplay can shape your borrowing costs and subsequently affect buyer demand, impacting how quickly you can sell your home.

Mortgage rates are also influenced by additional considerations that you should not overlook. These include market demand, housing inventory, and geopolitical events that can create uncertainty. Moreover, lenders may adjust rates based on their operational costs. Keeping informed about these factors can empower you to make strategic decisions in the market.

- Market demand

- Housing inventory

- Geopolitical factors

- Lender-specific adjustments

This comprehensive understanding will help you navigate the real estate landscape effectively.

The Relationship Between Mortgage Rates and Home Sales

Even slight fluctuations in mortgage rates can significantly impact the dynamics of home sales. Higher rates often deter buyers, as their monthly payments increase, while lower rates can stimulate interest in the housing market. Understanding this relationship is key for you if you’re considering selling your home. You can explore more about this in our article on Should I Sell My House Now Or Wait?.

How Rates Affect Buyer Affordability

Across the housing market, mortgage rates directly influence how much home buyers can afford. When rates rise, the buying power of potential homeowners typically diminishes, making them hesitant to engage in purchases. Conversely, lower rates can enhance affordability, prompting more consumers to enter the market.

Impact on Housing Demand

Mortgage rates play a significant role in shaping housing demand. When rates are favorable, more buyers feel empowered to enter the market, stimulating demand and potentially leading to quicker sales for sellers. In contrast, when rates rise, buyers may retreat, leading to a slowdown in sales activity.

Affordability directly affects the overall demand in the housing market. As mortgage rates rise, fewer buyers can afford to purchase homes at the same price points, which can result in longer selling times. Conversely, when rates are lower, even more buyers can compete for available homes, leading to increased demand and quicker sales. You should consider these factors as they can significantly impact your selling strategy.

Timing the Market: Selling Strategies

Now, understanding how to time the market effectively can significantly impact the sale of your home. Awareness of mortgage rates and their trends can help you develop strategies that attract potential buyers. By aligning your selling efforts with favorable market conditions, you can increase your chances of a swift and profitable sale.

Best Time to Sell Based on Rates

Market conditions can fluctuate, but selling your home during periods of lower mortgage rates typically leads to a larger pool of buyers. When rates are down, buyers are more likely to see affordability in purchasing homes, which can shorten the selling timeframe. Keep an eye on financial news and trends to identify the best moments to list your property.

Marketing Homes in a High-Rate Environment

Besides adjusting your pricing strategy, effectively marketing your home when mortgage rates are high requires creativity. Tailoring your pitch to showcase the value of your property can make a difference. Consider highlighting energy-efficient features or the potential for future appreciation to attract buyers who might be hesitant due to high financing costs.

Sell your home by focusing on its unique attributes and opportunities. High rates may deter some buyers, but you can appeal to those who see beyond current rates by emphasizing lower utility costs or innovative financing options. Your marketing should portray your home as a desirable choice, despite prevailing market challenges, helping to stimulate interest even in tougher environments.

Regional Variations in Mortgage Rates and Home Sales

For home sellers and buyers alike, understanding how regional variations in mortgage rates impact home sales can significantly influence your real estate decisions. Different areas often face varying economic conditions, resulting in fluctuating mortgage rates that can alter demand. As you explore the housing market, recognizing these regional disparities can empower you to make informed choices that align with local selling trends.

Differences by Location

Location plays a pivotal role in determining mortgage rates and home sales activity. Urban areas typically experience higher demand and, consequently, can command higher mortgage rates, while rural regions may see lower rates but slower sales. This variance can directly affect how quickly you can sell your home, depending on where it is situated.

Case Studies of Fast vs. Slow Sales

An examination of real-life case studies reveals how mortgage rates and regional characteristics influence sales speeds. Here are some detailed examples:

- Seattle, WA: Average mortgage rate of 3.2% led to homes selling within 18 days on the market.

- Detroit, MI: Higher rates averaging 4.5% resulted in homes taking 45 days to sell.

- Austin, TX: With a rate of 3.5%, properties sold in just 12 days, showcasing high demand.

- Cleveland, OH: A mortgage rate of 4.0% correlated with an average 40-day selling timeline.

Variations in home sale speeds, as highlighted in these case studies, underscore the importance of local market conditions and mortgage rates. You should consider these factors when preparing your home for sale or looking to purchase one. The quicker sales in Seattle and Austin reflect stronger buyer interest, while Detroit and Cleveland showcase the impact of higher rates on slower-moving markets. Understanding these dynamics can help you navigate your local real estate landscape more effectively.

Economic Indicators and Market Sentiment

Not all economic indicators impact the housing market equally. When mortgage rates change, they can affect buyer confidence, ultimately influencing how quickly your home sells. Understanding both local and national economic trends will help you gauge the market sentiment and adjust your selling strategy for optimal results.

Role of Economic Trends

Economic indicators, such as unemployment rates and GDP growth, play a significant role in shaping the housing market. When these trends show positive movement, buyer activity typically increases, resulting in faster home sales. Conversely, negative economic signals may lead to buyer hesitation, extending your home’s time on the market.

Consumer Confidence and Its Effect on Sales

Sales data often reflects consumer confidence in the economy. When people feel secure in their jobs and financial situations, they are more likely to make significant investments, including buying homes. This confidence can accelerate sales, making it imperative for you to consider broader economic conditions when pricing and marketing your property.

Trends in consumer confidence connect strongly to real estate activity. When potential buyers perceive a stable or improving economy, they are more willing to commit to purchasing a home, which can lead to quicker sales for you. Conversely, a decline in consumer confidence may cause prospective buyers to pause, prolonging your home’s time on the market. Staying informed about these trends can help you strategize effectively and navigate your sale with greater ease.

Summing Up

From above, you can see how mortgage rates significantly impact the time it takes to sell your home. Higher rates may deter potential buyers, leading to longer listing periods and possibly lower offers. Conversely, when rates are low, buyer activity typically increases, making your home more appealing and likely resulting in a quicker sale. Staying informed about current interest rates and adjusting your selling strategy accordingly can enhance your chances of a timely transaction.

Q: How do lower mortgage rates affect the demand for homes?

A: Lower mortgage rates typically lead to increased demand for homes. When interest rates decrease, monthly mortgage payments become more affordable for buyers. This can attract a larger pool of potential buyers, which often results in homes selling faster. As buyers have more purchasing power, they may be willing to compete more aggressively, potentially leading to quicker sales and even higher offers.

Q: What impact do higher mortgage rates have on the time it takes to sell a home?

A: Higher mortgage rates can slow down the home-selling process. When interest rates rise, the cost of borrowing increases, which may deter potential buyers from entering the market. As a result, fewer people may be willing or able to make offers, leading to longer selling times. Homes may sit on the market for extended periods as sellers may need to lower their prices or provide additional incentives to attract buyers.

Q: Can a seller influence the selling time despite prevailing mortgage rates?

A: Yes, sellers can still influence the time it takes to sell their home, even in a fluctuating mortgage rate environment. Factors such as pricing strategy, property condition, and marketing efforts play significant roles. For instance, setting a competitive price based on market analysis or making improvements to the home can attract buyers, regardless of mortgage rates. Additionally, effective marketing and staging can enhance the home’s appeal and expedite the selling process.