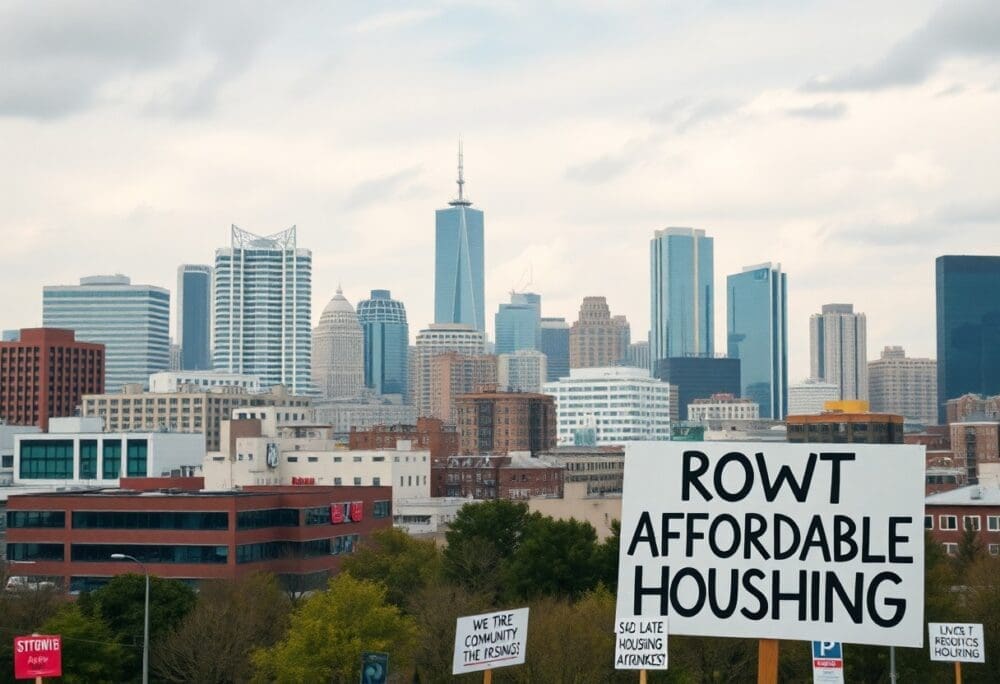

RealEstate markets are influenced by various political movements, and populism is no exception. As you navigate the complex world of commercial real estate, understanding how populist sentiments might shape regulations, investment opportunities, and market behavior is vital. These shifts could affect everything from zoning laws to financing options, impacting both your investment strategies and future property values. In this blog post, we will explore the potential repercussions of populism on commercial real estate, equipping you with insights to adapt to an evolving landscape.

Key Takeaways:

- Populist movements may reshape zoning laws and regulatory frameworks, potentially leading to increased restrictions or incentives for local businesses and real estate development.

- As public sentiment shifts toward protecting local interests, demand for commercial properties that serve community needs may rise, while large-scale, corporate-led developments could face scrutiny and opposition.

- Investment strategies in commercial real estate could pivot towards more socially responsible and sustainable practices in response to rising populist sentiments that emphasize localism and equity.

Understanding Populism

As you research into the complexities of populism, it becomes clear that its influence extends beyond politics, seeping into various sectors, including commercial real estate. Understanding this phenomenon is imperative for anticipating shifts in economic and social landscapes that can impact your investments and property management strategies. Populism often emerges in response to perceived disconnect between governing elites and the common populace, prompting significant changes that resonate within the real estate market.

Definition and Characteristics

Before exploring populism further, it’s important to define it. Populism generally refers to a political approach that seeks to represent the interests of ordinary people, often juxtaposed against a perceived corrupt elite. Key characteristics include charismatic leadership, emotional rhetoric, and a focus on nationalism, which can reshape public sentiment and influence economic policies.

Historical Context

Behind the emergence of modern populism lies a rich historical context shaped by socioeconomic changes, including economic inequality and political disillusionment. These factors have fueled movements across the globe, from the early 20th century labor movements to contemporary parties that challenge the status quo.

Indeed, understanding the historical context of populism allows you to see how shifting economic conditions can trigger populist movements. The aftermath of the 2008 financial crisis, for example, contributed to rising dissatisfaction among the populace, leading to the popularity of anti-establishment figures and parties. This has implications for your real estate investments, as populist platforms often prioritize local interests over global integration, potentially altering market demands and driving policy changes that affect property values and development opportunities.

The Current State of Commercial Real Estate

If you are looking at the commercial real estate sector, you’ll find it navigating through a mix of stability and uncertainty in the face of shifting economic landscapes. These changes are often influenced by broader political narratives, including rising populism, which impacts investment and development patterns. For an in-depth understanding, check out the Full article: Housing and populism.

Key Trends and Market Dynamics

Any shift in consumer behavior, technology advancements, and evolving regulatory frameworks are significantly shaping the commercial real estate landscape. These changes influence where and how people work, shop, and engage with services, presenting both opportunities and challenges for investors and stakeholders alike.

Challenges Facing the Industry

Across the commercial real estate industry, you are likely to encounter various challenges that stem from economic fluctuations, regulatory changes, and shifting consumer preferences. Understanding these issues is crucial for navigating potential risks and capitalizing on emerging opportunities.

With the growing influence of populism, you may see increased scrutiny on large corporations and higher demands for local accountability. This can lead to regulatory changes that affect development projects and zoning laws, complicating your investment strategies. Additionally, the rising focus on sustainability and social equity may require you to rethink traditional business models, pushing you to adapt your approach in order to remain competitive in this evolving market.

Populism’s Influence on Economic Policy

After a surge in populist sentiments, economic policies tend to shift towards protectionism and interventionism, fundamentally altering the landscape in which commercial real estate operates. You may notice increased government involvement in markets, which can create both opportunities and challenges for property investors and developers. The nuances of these policies can reshape demand and regulatory frameworks, impacting your ability to navigate the real estate sector effectively.

Regulatory Changes

Among the notable impacts of populism are regulatory changes that emerge in response to public sentiment. These changes can lead to stricter zoning laws or the introduction of new compliance requirements, which could affect your development plans or investment portfolios. Staying informed on these regulatory shifts is vital for adjusting your strategies accordingly.

Taxation and Investment Strategies

Between rising populism and shifting economic policies, taxation frameworks also face potential reform. This environment may require you to reassess your investment strategies to optimize returns while navigating evolving tax implications. Understanding these changes can guide your decision-making process and enhance your positioning in the commercial real estate market.

Even minor adjustments to tax codes influenced by populist movements can have profound effects on your commercial real estate investments. Incentives for local businesses may increase, yet new taxes or fees could emerge, impacting cash flow and profitability. You’ll need to closely evaluate how these changes affect your investment strategy and property valuations to remain competitive in an evolving market landscape.

Shifts in Consumer Behavior

Once again, the rise of populism is influencing shifts in consumer behavior, altering expectations and demands in commercial real estate. As economic frustrations mount, individuals increasingly prioritize local businesses and sustainable practices, creating new market dynamics. This shift affects retail and office spaces, prompting landlords and investors to adapt to the evolving landscape. Your understanding of these changes will be necessary in navigating opportunities in this transforming market.

Demand for Localism

Localism signifies a growing preference for supporting neighborhood enterprises over large corporations. As consumers lean towards brands that resonate with their values, you may find yourself interested in properties that cater to these small, impactful businesses. This shift not only reflects changing consumer sentiment but also creates potential avenues for investment in local commercial real estate. Expect to witness significant changes as local establishments thrive.

Impact on Property Types

Before delving into the impact on property types, it’s necessary to note how populism directs attention to different commercial real estate segments. As consumer preferences evolve, you may observe significant transformations across various property categories. Understanding which property types are favored can help you make informed investment decisions, ensuring alignment with market trends.

| Property Type | Impact |

|---|---|

| Retail Spaces | Increased demand for local and unique offerings. |

| Office Buildings | Shift towards flexible spaces accommodating remote work. |

| Industrial | Focus on last-mile delivery and logistics in urban areas. |

| Mixed-Use Developments | Popularity grows as they combine living, working, and leisure. |

| Hospitality | Local experiences gain traction over traditional services. |

But as populism continues to shape the landscape of commercial real estate, understanding its impact on property types is vital. Changing consumer behaviors suggest a strong preference for spaces that foster community and engagement. You’ll want to stay attuned to these trends to successfully navigate investment choices in the following sectors:

- Community-oriented retail and dining establishments.

- Flexible workspaces accommodating hybrid models.

- Logistics and distribution centers for e-commerce.

- Residential spaces connected to commercial facilities.

- Unique hospitality experiences aligned with local cultures.

The evolution of these property types emphasizes the need for adaptability in your investment strategies to capture emerging opportunities.

Potential Changes in Development Strategies

To adapt to the rising influence of populism, developers may shift their strategies towards more inclusive and community-focused projects. You may find that this approach not only enhances local engagement but also fosters a sense of ownership among residents. By incorporating feedback from the populace, you can create spaces that genuinely reflect community needs, ensuring long-term viability and support.

Community-Centric Projects

Across various regions, you will observe a trend toward developing community-centric projects. These initiatives prioritize local input and aim to create synergistic environments that cater to the residents’ desires. This shift can lead to enhanced public spaces, mixed-use developments, and affordable housing options, fundamentally reshaping the landscape of commercial real estate.

Adaptive Reuse and Sustainability

About the evolving landscape of commercial real estate, adaptive reuse and sustainability are becoming increasingly significant. As you embrace these principles, you may find that repurposing existing structures not only conserves resources but also meets growing demand for eco-friendly spaces. By integrating sustainable initiatives in your projects, you can appeal to environmentally conscious consumers and stakeholders alike.

Projects that prioritize adaptive reuse often bring new life to underutilized buildings, transforming them into vibrant hubs that reflect contemporary values while honoring historical character. You can maximize resources by recycling materials, minimizing waste, and reducing energy consumption. As a result, your developments can resonate with a movement that champions sustainability, aligning with the demands of an increasingly eco-aware market.

Long-term Implications for Investors

All investors must consider the shifting dynamics of commercial real estate in the wake of rising populism. As political sentiments influence policies, the market may experience volatility that alters asset values and tenant demand. Your investment strategy requires adaptation to these new realities, emphasizing the importance of thorough market analysis and flexibility in portfolio management. Understanding the implications of populist movements will be necessary for long-term success in a changing landscape.

Risk Assessment in a Populist Environment

After analyzing current trends, you should assess how populism influences regulatory frameworks, tax policies, and economic stability. The unpredictability of such environments can elevate risks associated with property investment. Your due diligence must extend beyond traditional metrics, incorporating political and socio-economic factors that might impact tenant profiles, financing options, and operational costs.

Opportunities for Innovation

To navigate the evolving market landscape, you can identify unique opportunities for innovation. As populism drives changes in consumer preferences and government support, adaptive strategies will be paramount. You may focus on sustainable development or utilize technology to enhance tenant experiences, positioning your investments to meet emerging demands effectively.

It is necessary to embrace innovative approaches as you respond to the demands of a populist backdrop. Consider investing in adaptive reuse projects or smart building technologies that appeal to evolving tenant preferences. Furthermore, fostering community-focused spaces can enhance the value of your properties while aligning with the populist ideals of localism and accessibility. By prioritizing innovation, you position yourself to capture new market segments and respond proactively to future shifts in commercial real estate trends.

To wrap up

To wrap up, understanding the influence of populism on commercial real estate can empower you to anticipate shifts in market dynamics. As populist movements often prioritize local interests and community needs, you may find that your investment strategies must adapt to rising demand for projects that align with these values. Staying informed about policy changes and public sentiment can help you navigate potential challenges and seize opportunities in this evolving landscape, ultimately allowing you to make more strategic decisions for your portfolio.

FAQ

Q: What are the potential impacts of populism on commercial real estate demand?

A: Populism can shift consumer behavior and preferences, leading to changes in commercial real estate demand. For example, a rise in populist sentiment might encourage local businesses as communities rally against large corporations. This shift could result in greater demand for retail spaces that cater to small businesses, local markets, and experiential centers, while traditional retail giants might face a downturn. Additionally, populist policies often emphasize local investment, which can increase demand for commercial real estate in areas that were previously overlooked.

Q: How could populism influence commercial real estate regulations?

A: Populist movements typically advocate for policies that prioritize the needs of local communities over larger corporate interests. This could lead to stricter regulations on commercial real estate development, such as zoning laws that favor smaller developments or more community-oriented projects. In addition, populist leaders may push for increased transparency in real estate transactions and enhanced protections for tenants, which could reshape the landscape of commercial real estate by requiring developers to adhere to more stringent guidelines or by implementing rent control measures in certain areas.

Q: What role might populism play in the financing of commercial real estate projects?

A: Populism can affect the availability of financing for commercial real estate projects as political sentiment may influence funding sources. If populist policies lean towards supporting community banks or local lending institutions, developers might find it easier to secure funding through these channels instead of large national banks that typically back larger projects. Furthermore, populist agendas may include public funding initiatives for community development, which could provide alternative financing opportunities for commercial real estate projects focused on serving local needs and interests.