It’s common for homeowners like you to consider refinancing your mortgage when interest rates drop. By taking advantage of lower rates, you can reduce your monthly payments, shorten your loan term, or even access home equity. This blog post will explore the benefits of refinancing, helping you understand how these financial decisions can impact your budget and long-term goals. Whether you’re looking to save money or tap into your home’s value, refinancing could be a smart choice for your financial future.

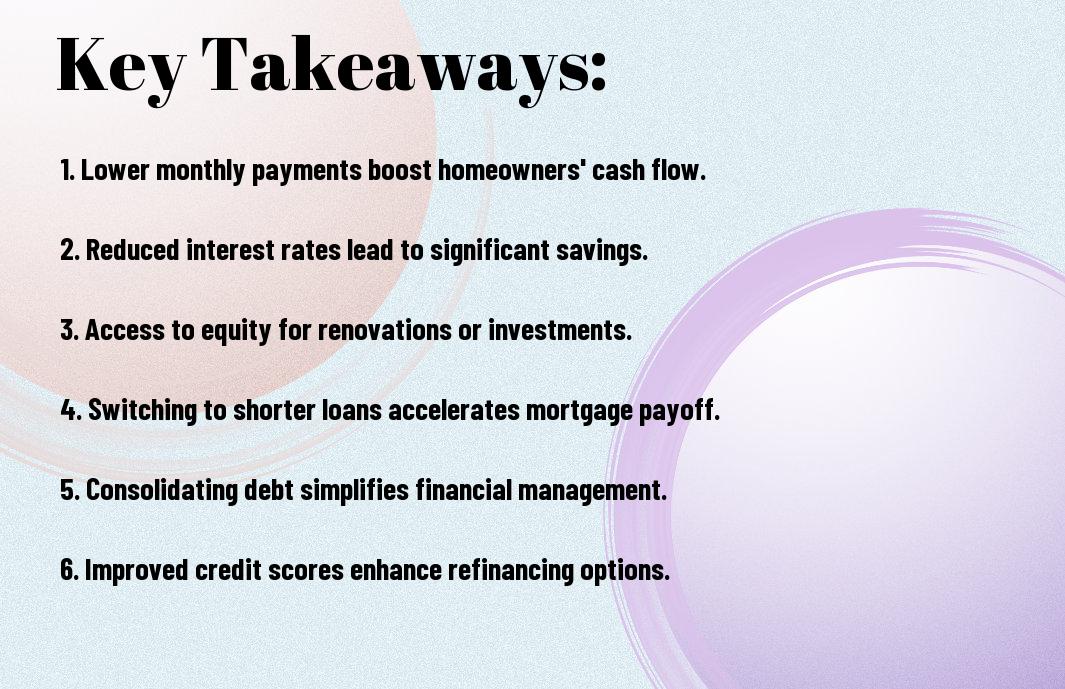

Key Takeaways:

- Homeowners often refinance to secure lower monthly payments, leading to significant savings over the life of the loan.

- Refinancing can also provide access to home equity, allowing homeowners to finance renovations or consolidate debt without taking on additional loans.

- Many homeowners take advantage of lower rates to shorten the term of their mortgage, enabling them to pay off their loan faster and reduce interest costs overall.

Understanding Mortgage Refinancing

To make informed decisions about your mortgage, it’s crucial to understand what refinancing entails. This financial strategy allows you to replace your current mortgage with a new one, often with different terms and a lower interest rate, potentially resulting in reduced monthly payments and overall loan costs.

Definition of Refinancing

Refinancing involves obtaining a new mortgage to replace your existing one, often with the goal of securing a lower interest rate, adjusting the loan term, or accessing home equity for other financial needs.

Benefits of Refinancing

Mortgage refinancing can offer various advantages, including lower monthly payments, reduced interest rates, access to cash through equity, or even switching from an adjustable-rate mortgage to a fixed-rate mortgage for stability.

Definition of refinancing goes beyond just replacing your existing loan. It serves as a strategic financial tool that can help enhance your financial situation. By lowering your interest rate, you can decrease your monthly payment and overall interest burden. If you choose to take cash out, you can invest in home improvements or pay down debt. Additionally, refinancing gives you the option to alter the length of your loan, tailoring it to your current financial goals.

The Impact of Low Mortgage Rates

One significant advantage of low mortgage rates is the potential for substantial savings on your overall loan cost. When rates drop, you have the opportunity to lower your monthly payments, reduce the total interest paid over the life of the loan, and potentially shorten your loan term. This can provide you with greater financial flexibility and the ability to allocate your money toward other important aspects of your life or investments.

Cost Savings on Monthly Payments

With reduced mortgage rates, you can see a noticeable decrease in your monthly payment. This immediate savings can ease your monthly financial burden, allowing you to redirect your budget towards savings, investments, or other expenses that matter to you. By refinancing at a lower rate, you effectively keep more money in your pocket every month.

Access to Better Loan Terms

Among the many benefits of refinancing at lower mortgage rates, accessing better loan terms often stands out. Many homeowners are able to secure improved conditions, such as a shorter loan duration or the elimination of private mortgage insurance (PMI), leading to even greater savings over time.

This means that not only do you enjoy lower payments, but you could also position yourself to pay off your mortgage sooner or eliminate unnecessary fees. By refinancing, you can negotiate terms that benefit you in the long run, such as fixed rates that provide stability and predictability in your financial planning. Enhanced loan terms can contribute to building equity faster and ultimately help you achieve your homeownership goals more efficiently.

Reasons Homeowners Choose to Refinance

Now, many homeowners opt to refinance their mortgages for various reasons, especially when interest rates are low. They seek to reduce their monthly payments, tap into equity, or achieve a more favorable loan term. Each situation is unique, and understanding your motivations can help you make the best financial decision for your future.

Debt Consolidation

Between mounting debts and rising interest rates on credit cards and personal loans, homeowners may find refinancing an appealing option to consolidate these debts into one manageable mortgage payment. By doing so, you can often secure a lower interest rate and streamline your finances, potentially saving you money over time.

Home Improvements

Across the board, many homeowners choose to refinance to fund home improvements. Upgrading your home can increase its market value and enhance your living experience, making this a wise investment. Refinancing allows you to access your home’s equity, using those funds for renovations that can yield significant return on investment.

For instance, you might consider refinancing to finance a kitchen remodel or a bathroom upgrade, which not only improves your quality of life but also makes your home more attractive to potential buyers. By tapping into your home equity with a refinanced mortgage, you can take on substantial projects without straining your monthly budget, positioning your property for greater appreciation down the line.

Timing Your Refinance

Despite the allure of low mortgage rates, timing your refinance should be a well-considered decision. You may want to explore when to refinance, especially when mortgage rates are at a two-year low. Evaluating the right moment can significantly impact the financial benefits of the process.

Market Trends and Timing

Besides personal factors, market trends play a significant role in your refinancing decision. Analyzing the broader economic landscape and keeping an eye on mortgage rate fluctuations can help you pinpoint the most favorable times to act.

Individual Financial Situations

Among the various factors to consider, your unique financial situation holds substantial weight in the refinancing process. Your credit score, current mortgage terms, and overall financial health determine the best time to refinance for optimal savings.

And as you assess your individual financial situation, evaluate how your income stability and future financial goals align with refinancing. This means considering whether enhancing cash flow, lowering monthly payments, or securing a better interest rate best supports your objectives. Tailoring your strategy based on your personal financial landscape will help ensure the refinancing process is not just beneficial, but truly advantageous for your long-term financial planning.

The Refinancing Process

Unlike your original mortgage process, refinancing typically requires less rigmarole. You’ll need to gather financial documents, review your credit, and shop around for the best loan terms. Once you choose a lender, they will evaluate your application, conduct an appraisal, and finalize the new loan, allowing you to either lower your monthly payments or tap into your home’s equity.

Steps to Refinance

Against the common belief that refinancing is a daunting task, the process can be straightforward. First, assess your reasons for refinancing and run the numbers to ensure it makes financial sense. Next, gather necessary documentation, shop for lenders, and submit applications. After approval, you will close on the new loan, giving you access to better terms.

Common Pitfalls to Avoid

Among the missteps you might encounter during refinancing are overlooking fees, failing to understand loan terms, or not verifying your credit score. These pitfalls can lead to unexpected costs or unfavorable loan conditions.

But being aware of these pitfalls can help you navigate the refinancing process more effectively. For instance, many homeowners underestimate the closing costs involved, which can sometimes offset the benefits of lower rates. It’s also important to carefully evaluate the long-term implications of any new loan terms. Ensure that you read and understand the fine print, and check your credit history beforehand to avoid surprises. By taking these precautions, you can make the refinancing process beneficial for your financial situation.

Alternatives to Refinancing

Many homeowners explore alternatives to refinancing, especially when it comes to modifying their existing loans or considering other financing options. These alternatives can sometimes provide relief without the need for a new mortgage, helping you maintain financial flexibility while adjusting your payment strategy to fit your current situation.

Loan Modifications

Between you and your lender, a loan modification can provide a pathway to more manageable payments. This process typically involves extending the loan term or changing the interest rate to decrease your monthly payments, making it a suitable option if you face temporary financial setbacks and want to stay in your home.

Other Financing Options

Other options may include personal loans, home equity lines of credit (HELOCs), or even government assistance programs. Each of these avenues has distinct benefits that can work alongside your existing mortgage without the need for a complete refinance.

Considering these alternatives can help you manage your finances more effectively. A personal loan may provide quick funds for urgent expenses, while a HELOC can leverage your home equity for larger projects or debt consolidation. Each option can be tailored to your specific financial needs, allowing you to maintain control over your financial landscape without entering a new mortgage agreement.

Summing up

Ultimately, refinancing your mortgage when rates are low can lead to significant savings and improved financial flexibility. By lowering your monthly payments or accessing home equity, you can enhance your financial situation and adaptability. This strategy not only minimizes interest costs over time but also aligns your mortgage terms with your current financial goals. Assess your unique needs and consider the benefits of refinancing to make the most informed decision for your home and your finances.

Q: What are the primary reasons homeowners refinance when mortgage rates drop?

A: Homeowners typically refinance to take advantage of lower interest rates, which can lead to significant savings over the life of the loan. This could involve reducing monthly payments, shortening the loan term, or switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage for more stability. Additionally, refinancing can be used to tap into home equity for cash, enabling homeowners to consolidate debt or fund large expenses.

Q: How does refinancing affect a homeowner’s monthly payments?

A: When homeowners refinance at a lower interest rate, they may see a decrease in their monthly mortgage payments. For example, if the original mortgage was at a high rate and is refinanced to a lower rate, the monthly obligation could be reduced significantly, allowing homeowners to allocate more money towards savings or other expenses. However, the specific impact on monthly payments will depend on the new interest rate, the remaining balance of the mortgage, and the loan term.

Q: Is refinancing worth it if there are closing costs involved?

A: While refinancing does come with closing costs, homeowners often find it worthwhile if the long-term savings from a lower interest rate outweigh these upfront costs. It’s important for homeowners to calculate the break-even point—when the savings from lower payments surpass the costs of refinancing. If they plan to stay in their home for several years, refinancing may offer substantial savings over time, making it a beneficial financial decision.